Elevate Your Brand: Essential Customer Metrics Every Fashion and Luxury Brand Should Measure

Table of Content

- What to Measure – Customer Key Metrics and KPIs

- Customer Funnel Metrics

- Customer Loyalty Metrics

- Customer Experience Metrics

- Case Study - Connecting the Dots

- Other Measures for Customer Base and Behavior

- Other Essential Metrics for Fashion and Luxury Brands

- Implementing a Data-Driven Strategy

- Elevate Your Brand

In the highly competitive world of fashion, lifestyle, and luxury brands, understanding your Customer is more than a necessity—it's the key to unlocking unparalleled growth and sustainability. With its unique blend of tradition and innovation, the fashion and luxury market presents challenges and opportunities for brands aiming to enhance their market presence and customer loyalty. In this article, we delve into the crucial metrics and KPIs that we highly recommend fashion and luxury brands monitor to decipher the dynamics of their business performance and the evolving preferences of their affluent customer base.

What to Measure - Customer Key Metrics and KPIs

To get a 360 view of your customers, we need to measure and track three main customer engagement aspects:

- Customer Funnel: How efficiently are you reaching, informing, attracting, and converting your prospects into purchasing customers?

- Customer Loyalty: Are your purchasing customers coming back and making repeat purchases?

- Customer Experience: How much your customers are purchasing? How often are they purchasing? What products are your customers purchasing?

Note that all the metrics covering these aspects are interconnected and collectively impact your brand performance. Each metric not only stands alone but also contributes to a broader understanding of customer engagement and business success.

Customer Funnel Metrics

Customer Funnel from top to bottom: Awareness, Consideration, Desire, Conversion

Customer Funnel, or Marketing Funnel, usually outline four-stage pre-purchase steps:

- Awareness: getting your brand name and messaging out to your target market.

- Interest/Consideration: Inform and educate your targets on how your products solve their needs.

- Desire: attracting prospects to consider and explore your products and solutions.

- Action/Conversion: converting your prospects into purchased customers.

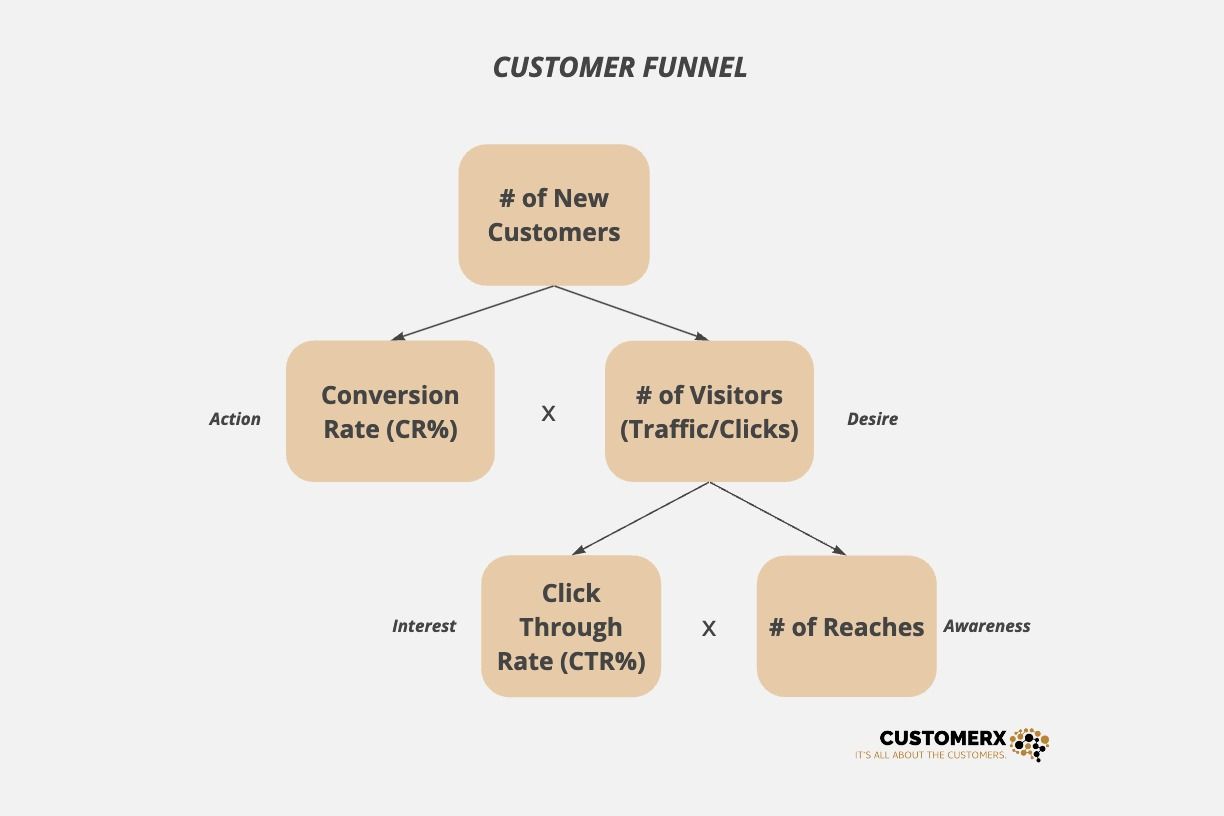

Customer Key Metrics Tree - Customer Funnel

To understand what steps your brand could improve to acquire more new customers, you need to measure the following four metrics.

# of Reaches

Different from # of impressions, # of reaches measures the distinct number of your targeted prospects who see your brand marketing content.

· In the digital world, it doesn't take much effort for you to measure if you have display advertising;

· In B&M, however, you may use the foot traffic of the department store or the shopping center where your boutique is located to get the number. Note that this metric could be overstated in this case, as it's challenging to distinguish unique prospects who have walked by and seen your boutique and brand.

Click Through Rate (CTR)

CTR measures the percentage of reaches that lead to a click or walk-in. When your display—either digital display marketing or a physical visual display in your boutique—successfully entices your prospects' interest, they will click your ads or walk into your store.

This metric measures the effectiveness of your display advertising and your visual display in the boutique.

Typically, the benchmark for this measure in fashion and luxury brands ranges from 0.7% to 3.7%. We advise narrowing down the sector by comparing your CTR with your competitors for a more relevant insight.

# of Visitors (Traffic/Clicks)

The number of visitors (also known as traffic or clicks given the distribution channel) is the metric to measure the number of prospects that step into the third stage of the funnel. Usually, it's easier to calculate # of Reaches and # of Visitors and then get the CTR:

CTR = # of Visitors / # of Reaches

Conversion Rate (CR)

CR measures the percentage of visitors who get to the action stage and make a purchase. It measures the effectiveness of turning your prospects' interest and desire into sales.

The CR for fashion and luxury brands usually ranges from 1% to 2% but could even reach 20% if you are targeting a niche market – for instance, High-net-worth Individuals (HNWIs), Very-high-net-worth Individuals (VHNWIs), or Ultra-high-net-worth Individuals (UHNWIs).

# of New Customers

The number of newly acquired customers measures how many "new bloods" you bring into your brand. With personalized and elevated engagement experience nurturing, these customers have the potential to evolve into existing customers who would come back year after year and become loyalists of your brand.

With the # of New Customers, we can calculate CR:

CR = # of New Customers / # of Visitors

Note that as more and more brands are implementing multiple distribution channels – B&M boutiques, Outlets, E-commerce (Web, App, Social storefront, etc.), and so forth, it's essential to take an omnichannel perspective when measuring these metrics. To allocate weights and evaluate the effectiveness of each marketing channel, it's good practice to draft out a few typical customer journey maps to help your business identify which attribution model you would use to measure the overall marketing practices. This is beyond the scope of this article, but if you have any follow-up questions regarding this topic, please feel free to reach out to us or schedule a 1-on-1 so that we could help you navigate the challenges.

Customer Loyalty Metrics

Customer loyalty represents a customer's consistent preference for and patronage of a particular brand, driven by a deep appreciation for its quality, exclusivity, and the prestige associated with its products. It's a profound trust and emotional connection that a luxury brand fosters with its clients, often translating into repeat purchases and advocacy.

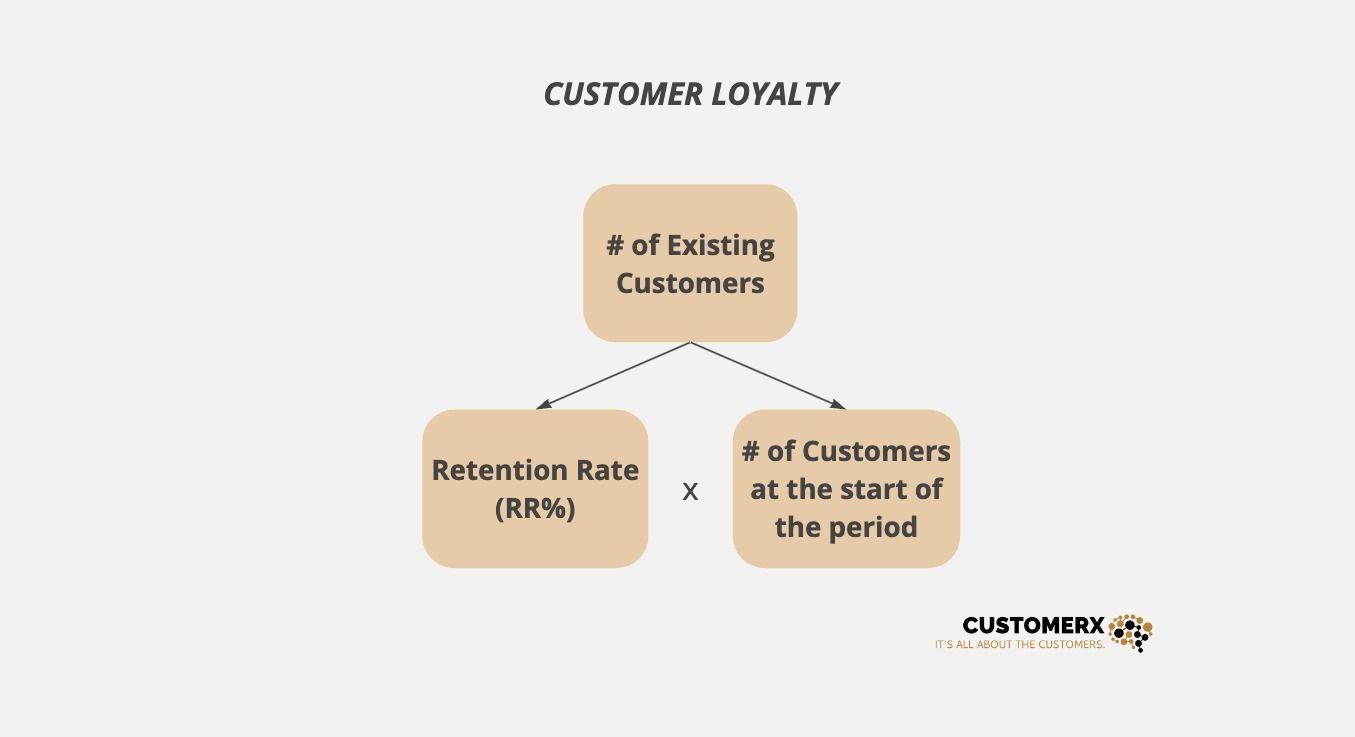

Customer Key Metrics Tree - Customer Loyalty

It's expensive to acquire new customers, and retaining existing customers is usually more sustainable and ensures the stability of the business. The key metrics for measuring your brand's customer loyalty are there to help you understand the number of existing customers and your retention rate.

Retention Rate (RR)

RR is the percentage of existing customers who continue to buy. It reflects customer satisfaction and loyalty, as it shows the portion of your customers who choose to stay and continue doing business with your brand at the beginning of a reporting period.

To calculate this metrics, we divide # of Existing Customers by # of Customers at the start of the period:

RR = # of Existing Customers / # of Customers at the start of the period

A healthy RR for fashion and luxury brands is around 20% to 40% but may vary, given your brand's typical purchasing cycle and reporting period.

Number of New vs. Existing Customers

While differentiating these two crucial metrics is essential for understanding growth and sustainability, note that it's equally important to retain new and existing customers—a new customer today could be your existing Customer in the future.It's expensive to acquire new customers, and retaining existing customers is usually more sustainable and ensures the stability of the business. The key metrics for measuring your brand's customer loyalty are there to help you understand the number of existing customers and your retention rate.

As a fashion or luxury brand, you need to identify how your new Customer's perspective on your positioning – why they purchase and do business with your brand, and what your existing customers expect – why they stay with your brand instead of going to a competitor.

A healthy ratio of New vs Existing is 4:6 to 3:7, which emphasizes the necessity of a well-designed loyalty program and exclusive treatments in place. Although you may not be able to compete with deep-pocket big brands' VIC perks, you can still stand out with your strategies to showcase how you value your high-value customers with access to exclusivity, scarcity, and personalization accompanied by your unique brand characteristics – which is what attracted your customers in the first place.

If you are interested in learning more about how to stand out in the fashion and luxury market by nurturing your existing customers with a unique and personal touch, feel free to chat with our founder to explore strategic solutions specifically for your brand and your customers.

Customer Experience Metrics

With efficient acquisition marketing practices and effective customer engagement and retention programs in place, we now need metrics to measure and understand how your customers' purchasing experiences are with your brand and products. These metrics are informative for you to dissect and improve any sales touchpoint that would benefit a stronger sales performance.

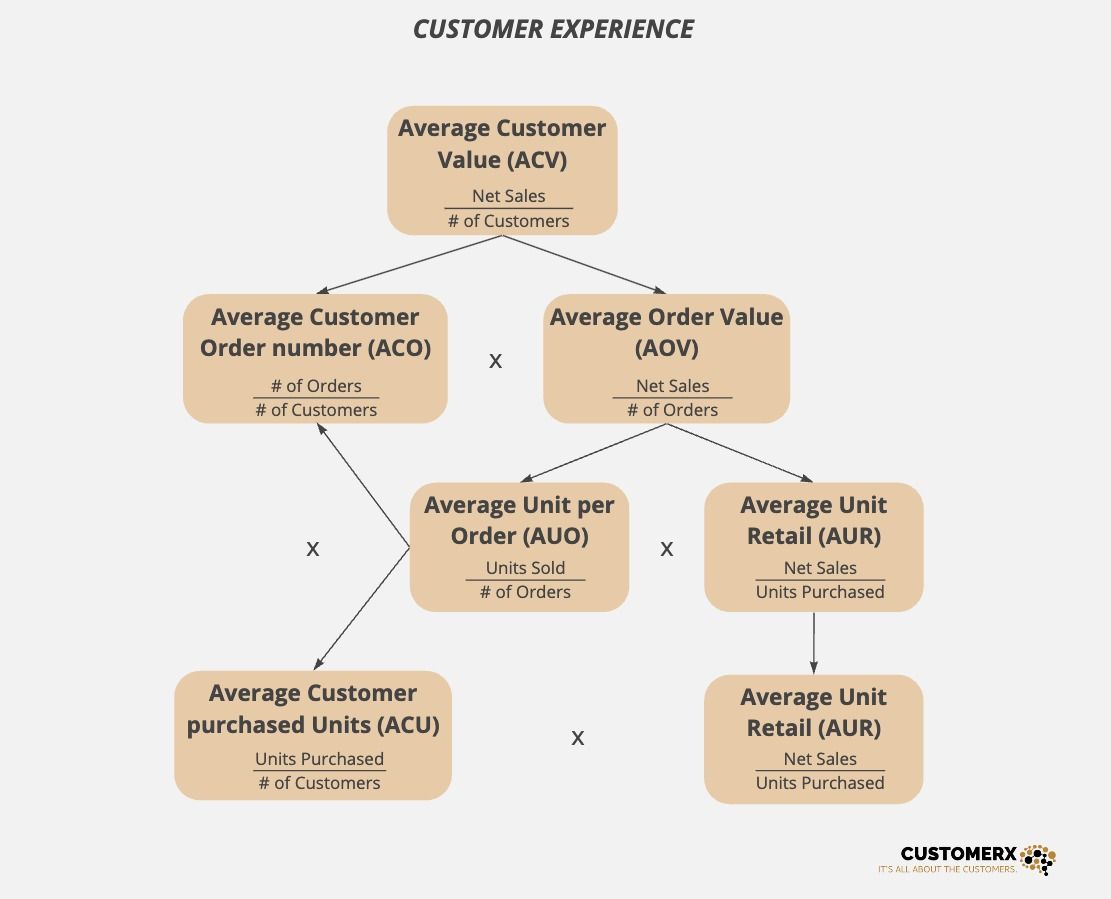

Average Customer Value (ACV) or Customer Lifetime Value (CLV)

ACV or LTV is a pivotal metric that measures the total value a customer brings to your brand throughout their relationship. It is calculated through the formula:

ACV = ACO * AOV

The latter of which can be further broken down into:

AOV = AUO * AUR

Understanding ACV helps in crafting targeted marketing strategies and enhancing customer retention efforts.

Average Order Value (AOV)

AOV gives insight into the average amount spent per order. Increasing AOV is crucial for maximizing revenue without necessarily increasing the customer base. Tactics such as cross-selling and upselling, when done tastefully, can significantly uplift AOV.

Average Unit Retail (AUR)

This metric offers a lens into the pricing strategy and product value perception. A high AUR can indicate a strong brand positioning and customer willingness to pay premium prices for perceived value. When raising your price point, consider the potential impact on declining demand.

Average Customer Order number (ACO)

ACO measures the average number of orders per Customer, indicating customer loyalty and repeat purchase behavior. A rising ACO suggests effective customer retention strategies.

Average Customer purchased Units (ACU) and Average Unit per Order (AUO)

These metrics provide insights into purchasing patterns. When combined with ACO, they give a full picture of the frequency of customers purchasing multiple units. They are crucial for inventory management, marketing strategy, and enhancing customer satisfaction.

As we observe from the tree graph above, all the above metrics are interconnected, leading to net sales when combined with the number of customers metric that we get by adding up the number of new and existing customers from the previous section. To identify the root cause of weak sales performances related to customers, we can simply get to a deeper level to spot the growth potential.

Case Study - Connecting the Dots

Let's discuss how these metrics interconnect and help us determine the root cause of changes in sales performance through a case study.

Supposing you notice your brand experiencing a -13% drop in sales year-over-year (YoY), as you delve deeper into # of customers and ACV (net sales = # of customers * ACV), you noticed a 5% growth in # of customers but having -17% ACV. Now, you get one level deeper and observe that the ACO was down slightly (-2%), and the AOV decreased by 15.5%. Clearly, AOV is the leading cause of the overall weaker performance. To dive further, you found that while your AUR surges at +10%, your AUO is down (-23%). The decline is due to a softer performance of ACO (as we discovered earlier), but more is due to a declining ACU (-22%).

Provided all the information, you realize that customers are responding to your raising price point and purchasing fewer units. There is also a trend of lower purchasing frequency, suggesting that while your prices are rising, the offerings, experiences, and services might not have been improved to justify the raise, or your current price point surpasses the Willingness-to-pay (WTP) of your current customer base, suggesting you need to acquire new customers and retain relevant existing customers given your business's shift of target.

The metrics of Customer Loyalty, a slightly lower RR% (-5%), verify our assumption regarding the offerings, experiences, and services. What's more, you figure that although the # of new customers is growing – contributed to the 5% growth of total customers – thanks to the improved # of Reaches from your marketing efforts, your CTR is decreasing and lower than the average benchmark. This finding supported the previous assumption of a shifted target market, suggesting you should adjust your marketing targeting strategy given your raised price point.

Please download the Customer Key Metrics Tree graph here for a consolidated view of how these key metrics interact and connect with each other.

Other Measures for Customer Base and Behavior

Beyond the basic metrics, luxury brands benefit significantly from deeper dives into customer segmentation and behavior analysis. This involves understanding the nuances between one-time purchasers and repeat buyers, analyzing the buyer's lifecycle stages, and employing the RFM model (Recency, Frequency, Monetary), among other measures. These measures enable brands to identify their most valuable customers and effectively tailor strategies to engage them.

Additionally, segmenting customers based on value, purchase behavior, demographics, or geographic location allows for more personalized marketing efforts.

Other Essential Metrics for Fashion and Luxury Brands

The dynamics of luxury brand marketing extend into analyzing the impact of full-price versus sale customers if your brand conducts markdown events for seasonal products. Online brands should also focus on device and channel analysis to optimize their digital marketing strategies across various platforms, including social media, email, and paid advertising.

In addition, Net Promoter Score (NPS) and Customer Effort Score (CES) could directly assess your customer loyalty and satisfaction and the ease with which customers can interact with your brand, from purchasing to customer service. High NPS indicates a strong customer connection to the brand's exclusivity and quality, which is essential for word-of-mouth marketing in luxury markets. On the other hand, a low-effort experience is crucial in luxury markets, as it reflects a brand's commitment to seamless, high-quality customer service, enhancing overall satisfaction and loyalty.

Implementing a Data-Driven Strategy

Integrating these metrics into a cohesive data-driven strategy requires not only the right analytical tools but also a mindset shift within the organization. Fashion, Lifestyle, and Luxury brands should leverage data analytics practices to gather comprehensive customer insights and monitor these key metrics continuously.

Elevate Your Brand

At CustomerX, we're more than just observers in the dynamic world of fashion, lifestyle, and luxury branding—we're partners in your journey to unparalleled success. If this exploration into the essential metrics of customer analysis has sparked ideas, questions, or the desire for a deeper dive, we're here to continue the conversation.

Are you ready to explore customized solutions tailored specifically to your brand's unique needs and mission? Schedule a one-on-one consultation with us today.

Together, let's unlock the full potential of your brand. Don't let this be the end of your journey toward mastering customer insights!

SHARE THIS BLOG